Sheffield Wednesday 2017/18: When the sun goes down

Championship football may be the most unpredictable and exciting in the country, but it comes at a price, and Sheffield Wednesday’s very delayed 2017/18 accounts are no exception.

Huge losses are run up in the division as chairmen leave common sense behind and twist on 18 in the hope of achieving promotion to ‘the promised land’ of 8pm kickoff on a Monday night at home to Watford.

Accountants can now be as valuable as strikers if they can come up with schemes that Baldrick from Blackadder would call ‘cunning’ and help clubs avoid the laughably called Profitability and Sustainability (P&S) points deductions of up to 12 points.

No club apart from Birmingham City has suffered a points deduction to date though but have Sheffield Wednesday pushed the rules to the limit in their accounts covering 14 months to 31 July 2018?

Income

Sheffield Wednesday should ideally show three types of income in their accounts, matchday, broadcast and commercial, but for reasons best known to owner Dejphon Chansiri they combine the first two, so some assumptions have been made.

Income from matchday sales decreased by 4% on the back of Wednesday having a forgettable season and finishing 15th compared to 4th in 2016/17 and average attendances dropped by 1,400 per home match.

Relative to other clubs in the division Wednesday have reasonably good attendances and had the fourth highest matchday income in 2017/18, although they did have 14 months instead of 12 when they were generating this sum, much of it out of season.

Income from broadcasting is mainly generated by solidarity payments from the Premier League (about £4.3 million) and the EFL deal with Sky (about £2.3 million plus appearance fees of £100-140,000 per home match).

If a club has been relegated from the Premier League in the last 2-3 years though it also receives parachute payments of £14-41 million.

Not receiving parachute payments puts the remaining Championship clubs at a significant disadvantage, although the Premier League argues such a system helps reduce the possibility of relegated clubs going out of business.

There are a few Championship owners who think they are short-changed with the present EFL TV deal but realistically they will struggle to generate significantly more than the existing arrangement, which is split 80% to the Championship, 12% to League One and 8% to League Two clubs.

Even if the Sky deal, which lasts five years, was scrapped, it’s unlikely that a new broadcaster would be willing to pay much more, as armchair fans tend to focus on the elite Premier League teams and the remainder of that division are simply fortunate that collective sale of rights takes place.

Revenue from commercial deals and sponsors was up 17% for Wednesday in 2017/18 to £7.1 million, although most of this was due to the additional two months of trading.

For clubs in the Championship it is a cut throat market trying to persuade sponsors to sign deals, but Wednesday have an advantage to a degree in that their shirts bear the owner’s name and there are other deals with Elev8 drink and sportswear and a local taxi company that appears to have no taxis, both of which are owned by the club owner which generated about £1.2 million.

Even taking into account the above issues Wednesday are at best mid table in terms of commercial income, reflecting the club being in the doldrums for so long in terms of national and global profile.

Relative to the period prior to Chansiri’s involvement with Wednesday, the club is now earning about £10 million a year more, but this is chicken feed compared to those in the Premier League or receiving parachute payments.

Costs

Every fan knows that the biggest costs for a football club relates to players and the Owls’ accounts illustrate this clearly.

Sheffield Wednesday’s wage bill increased by over a half to £42 million in 2017/18 as the owner backed the manager in the transfer market and also the full year cost of new contracts for the likes of Forestieri.

Wages in the Championship average £15,000 a week, and Wednesday are in the top half of this table at £20,300.

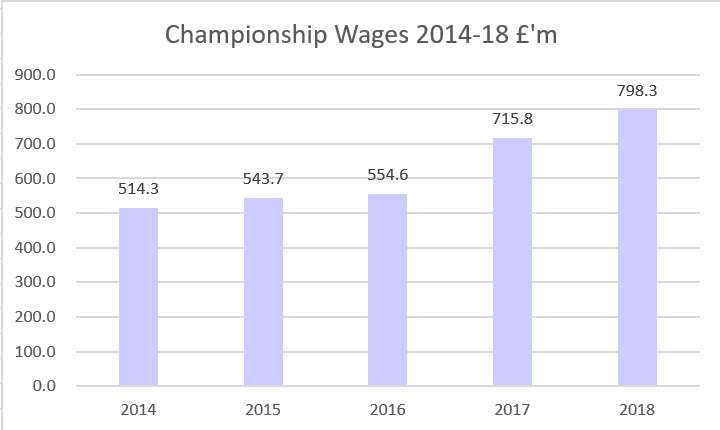

Increased rewards for promotion to the Premier League have resulted in Championship clubs paying higher and higher amounts in trying to get there.

The average wage paid by Wednesday has increased by 418% over the last decade, but most noticeably is how wages have nearly tripled in the last three years under Chansiri.

High player remuneration in the last three years has meant that Wednesday were paying £168 in wages for every £100 of income meaning the club is automatically making sizeable losses before any of the day to day running costs are incurred.

Getting wages under control was in theory one of the aims of Financial Fair Play, now called Profitability and Sustainability (P&S) rules but this would appear to have failed in the Championship as wages are now the highest ever compared to income.

Only in football would spending more money on wages than generated through revenue be applauded by many, but from a fans’ perspective so long as the club is promoted the end is justified by the means.

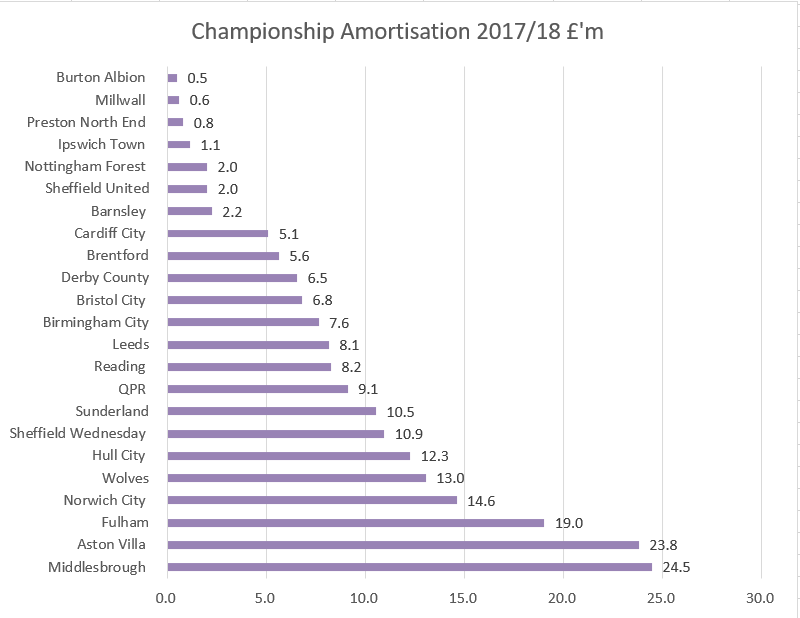

Amortisation is the other main expense in relation to players where the transfer fee is spread over the life of the contract such as Wednesday signing Jordan Rhodes for £8 million on a three-year contract this works out as £2.67 million amortisation a year.

The amortisation fee in the profit and loss account takes into account all the squad players signed for fees and reflects the longer term investment in transfers.

Sheffield Wednesday have spent substantial sums in the transfer market since Chansiri by their previous standards and this is reflected in the amortisation charge increasing by a factor of ten.

Profits/(Losses)

Profits are revenues less costs and the consequences of Wednesday’s recent splurge on player spending has meant that day to day losses increased rapidly and have averaged £420,000 a week under Chansiri.

Even though Wednesday’s losses last season were the largest in their history, they were still exceeded by seven other clubs in the Championship in 2017/18.

The only way that clubs can usually reduce these losses is via player sales or owners underwriting them. Wednesday have had relatively little success in terms of player sales in recent years though.

This unwillingness or inability to sell players for large fees isn’t unique to Wednesday, but some other clubs have been able to generate huge sums which are used to ensure P&S compliance.

Wednesday therefore took extreme measures to reduce the losses in selling Hillsborough. The agreed fee appears to be £60 million, as the stadium had a value in the accounts of £22m and so booked the difference of £38m as profit.

This transaction has been contentious in a number of ways. Under the old version of FFP profits on asset sales used to be disallowed and so there was no incentive for clubs to make disposals.

However, when the rules were brought into line with the Premier League in 2016, Shaun Harvey, the Mr Bean of football regulators, and co ignored a change which allowed asset sales to be included.

Derby County’s accountants were the first to spot this anomaly and ‘sold’ Pride Park for £80 million in their 2017/18 accounts to another company owned by chairman Mel Morris-Obe, helping to reduce a trading loss of £47 million. Aston Villa have done similar with Villa Park in the present season, which allowed them to keep Jack Grealish and be promoted on the back of his sublime skills, whilst transferring the stadium from the left to the right hands of the new owners after running up operating losses of £95 million in the first two years following relegation.

Wednesday have done the same, but the way they’ve gone about the sale of the ground has won them no favours. The ‘sale’ of the stadium is to a related party of Chansiri, was revealed in the footnotes to the accounts, but he clearly thinks that the fans have no right to know about such significant transactions.

There’s no indication as to the date of the sale or to which of Chansiri’s other companies the sale has been made. In the debtors note to the accounts there is a disclosure that indicates the sale proceeds are being spread over eight years.

If this is the case then presumably Wednesday should be able to charge interest on the outstanding payments. The price of £60 million has been queried in some circles, but presumably it has been assessed by an independent surveyor (appointed and paid for by Chansiri) and ticked off by the independent auditors (also appointed and paid for by Chansiri).

With the sale of the stadium it looks as if Wednesday would have made a P&S loss of just over £19 million in the three year assessment period. If the old FFP rules had still applied then the loss would have been £57 million and a likely 12 point penalty would have applied.

Player Trading

Under the previous regime Wednesday were cautious in the transfer market but Chansiri has allowed managers to recruit in order to try to achieve promotion.

A net spend of £10.7 million in 2017/18 was certainly competitive for last season but not excessive by Championship standards.

Owner Funding

Club owners can invest money in three ways, loans (which may or may not be interest bearing, share issues or related party transactions such as the stadium sale.

Since arriving at Hillsborough Chansiri has lent the club £65 million, and in September 2018 put in another £21 million via a new share issue.

Conclusion

Football should be about goal, chances, signings, red cards and abusing Mike Dean. If there are to be financial rules and regulations they should be robust and transparent.

The EFL’s P&S rules have proven to be weak and allowed rich owners to use expensive and creative accountants to devise schemes that achieve ‘compliance’ but having nothing to do with either Profitability or Sustainability.

In doing so the game is reduced to a rich man’s plaything and theres a lot of evidence that rich men think that rules don’t apply to them, as they can be ignored, bought or circumnavigated.

It’s no surprise that the three clubs who have applied the stadium sale and leaseback loophole are .owned by very wealthy people who consider themselves to be above the principles that FFP was supposed to be about, of preventing clubs ‘buying’ promotion or success by injecting as much money as was required to achieve their objectives.

Villa were promoted to the Premier League on the back of such behaviour, Derby made the playoff finals, suggesting that the concepts of sporting integrity that many hold dear are sneered at by the billionaires, multi-millionaires, weasel accountants and lawyers in their slick haircuts and sharp suits who wriggle their way through the small print and champion loopholes rather than football skill and prowess.

Wednesday have ended up with a soft transfer embargo due to Chansiri’s stubbornness in refusing to send in the accounts to the EFL by the due deadline. This has resulted in the club being unable to deal in the transfer market as easily as the manager would like.

The fans are left in the dark, they are lucky in a way to have an owner who is willing to empty his pockets (or rather those of his successful family) into Wednesday but at the same time his lack of football knowledge means he’s open to be taken advantage of by those who see the game purely as a commission making vehicle and a lot of money ( admittedly his) is wasted in the process.

If such benevolence results in promotion then no one cares, but if not then there’s little to cheer about if you’re an Owl, as you’re the person who invests emotionally every week in the club, when you renew your season ticket and when you travel 400 miles on a Tuesday night for an abysmal away performance out of loyalty and love for your club.

Ultimately it’s his club to do with as he sees fit, but having a soft transfer embargo as a result of some of his actions offsets the generosity he’s shown to players and managers over the last few years. It’s a shame because as an away fan a trip to Wednesday is a great day out.

So long as the money keeps coming in then fans can be happy as they have someone willing to fund transfers and wages. Speak to fans of Liverpool under Hicks and Gillett, Blackpool under the Oystons, Villa under Tony Xia, Birmingham under Carson Yeung, Bolton under Ken Anderson and Bury under the last two owners (as well as many others who I’ve not mentioned) and the issues of club governance and owner motives do give cause for concern.

2 Comments

John Vaughan

I do get this but without spending large sums the PL effectively is a closed shop. I don’t have an issue with rich people punting their own cash but the issue is that when it all goes pear shaped the club is left in a financially untenable position. So why not abandon the current regs and require owners to ensure financial viability at exit. That could be enforced via personal guarantees or bonds and the extent of them related to the loss on football related trading. The issue isn’t the ‘investment’ it’s tidying up the inevitable mess.

The Baron

Agree totally.