Middlesbrough 2017/18: Babylon’s Burning

To attempt promotion to the Premier League is an expensive business as revealed when Middlesbrough submit their accounts to the government registrar for the 2017/18 season and reported a £20.2 million operating loss

Only the receipt of parachute payments and some player sales prevented these losses from being too damaging for Boro, who are fortunate to have a benevolent owner in Steve Gibson to fund the club’s operations.

Key Financial Highlights for year ended 30 June 2018

Turnover £62 million (down 49%)

Wages £49 million (down 25%)

Pre-player sale losses £20.2 million (2016/17 profit £10.3 million)

Player sale profits £15.3 million (up from £11.3 million)

Player signings £66 million (up from £48 million)

Income

Nearly every club in its accounts splits income into three categories to comply with EFL League recommendations, matchday, broadcasting and commercial.

Year on year Middlesbrough’s matchday income fell by 18% last season to £7.1 million.

Premier League attendances averaged 30,499 and this fell to 25,544 in the Championship despite Boro having a relatively successful season and reaching the playoffs before losing to Villa.

Until parachute payments run out Middlesbrough are not hugely dependent upon matchday as an income source, as it only represents one pound out of every nine generated by the club last season.

Losing its Premier League status was a blow for the club and the town last season and being relegated in the first season after promotion means that Boro only are entitled to parachute payments for two seasons instead of three as would have been the case had they avoided relegation.

Income for clubs in the Championship from matchday varies depending upon ticket prices, attendances and the number of corporate seats each club is able to sell, with the likes of Villa and Leeds having an advantage in the latter two categories.

Such is the magnitude of the Premier League TV deal that Middlesbrough received over £41 million from parachute payments out of total broadcast income of £46.3 million in 2017/18.

Having another parachute payment this season will generate about £35 million, but Boro are promoted they will then revert to the EFL deal with Sky, which is worth about £2.3 million a year plus a £4.3 million ‘solidarity’ payment from the Premier League, this can then be topped up by £100,000 for each home fixture and £10,000 if the club are playing away if chosen for live broadcast.

A lot of clubs in the Premier League are reliant on the BT/Sky deal for the majority of their income and Boro are no exception, even in 2017/18 TV was still providing three-quarters of their revenue.

So, looking at the Championship as a whole it appears that parachute payments have created a two or three tier division, with those clubs who have just come down earning the most and then this tapers for those who have been relegated for two or three seasons.

Getting commercial partners to sign up for deals is more difficult in the Championship than the Premier League as sponsors prefer to see the names of their products when a team is playing Liverpool or Manchester United compared to Barnsley or Burton.

In Boro’s case commercial income fell nearly 30% to £8.6 million, which is less than two seasons previously when the club was promoted to the Premier League, although there may have been promotion bonuses paid that season.

Nevertheless, commercial deals can be significant and Boro are earning over £170,000 a week from such arrangements, which puts them into the top half of the table in the Championship sponsor-wise.

Growing commercial income is the best way for a club to increase overall income as broadcast income is negotiated centrally and matchday income can only go up if prices are raised (not popular with fans) or ground capacity increased (time consuming and expensive).

Earnings overall halved last season to £62 million and will fall by about a further £10 million in 2018/19 as parachute payments decrease, before returning to the £20m a year level unless ‘Boro are successful in being promoted by May.

Costs

Player costs

Running a football club is an expensive business and Middlesbrough’s main costs, like those of nearly all clubs, were in relation to players, in two forms, wages and amortisation.

Paying players a competitive wage is a challenge as owners and fans want promotion and to achieve that means acquiring top talent in an industry where small improvements in the quality of players doesn’t come cheap.

Usually when clubs are promoted they give players improved contracts with relegation clauses should the worse happen and Middlesbrough appear to have applied this principle to a degree as wages fell by a quarter in 2017/18.

Boro players still earned an average of £23,000 a week from our formula (we have no inside knowledge so this is an educated guess) as the club invested heavily in new signings as owner Steve Gibson tried to recruit players to help the club bounce straight back to the Premier League.

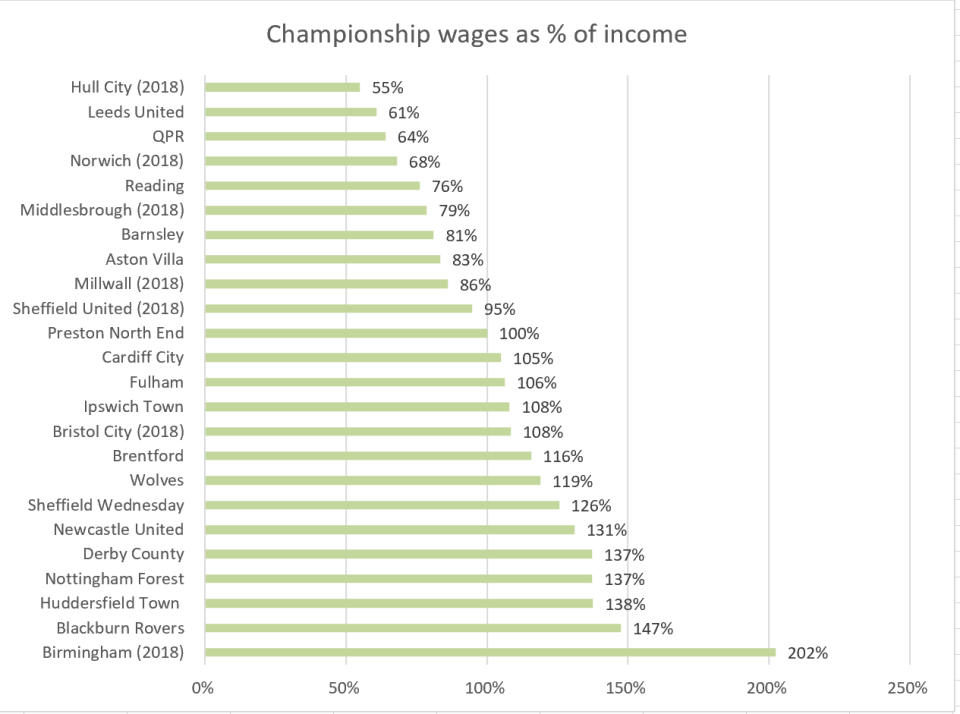

Earning so much from parachute payments meant that Middlesbrough ‘only’ paid out £79 in wages from every £100 of income last season, which is low by Championship standards, although this could rise substantially in 2019/20 should they fail to be promoted, unless there is a major clear out of highly paid players.

Sanity is in short supply in the Championship when it comes to wage control, with the division overall paying out £101 in wages for every £100 of income and Birmingham last season under I’m A Celebrity favourite Harry Redknapp somehow paying out twice that sum.

Player Amortisation

This is how a club deals with player transfers in the profit and loss account by spreading the cost over the contract period. For example, when Middlesbrough signed Britt Assombalonga from Forest in the summer of 2017 for £15 million on a four-year deal, this works out as an annual amortisation cost of £3.75 million (£15m/4). The amortisation cost in the profit and loss account represents the total for all players signed for fees in previous seasons.

Middlesbrough’s total amortisation surprisingly increased in 2017/18 compared to their season in the Premier League due to the club investing heavily in buying players in a bid to achieve owner Steve Gibson’s desire to ‘smash the league’ and ‘go up as champions’.

Consequently ‘Boro have the highest amortisation total of any club in the Championship for last season, although this could be overtaken when Villa eventually publish their results. Even so it is clear that Gibson has backed his managers in the transfer market.

Adding amortisation and depreciation together gives total player costs for Boro of £118 for every £100 of income.

Profit

Profit is income less costs, but it contains lots of layers and estimated figures. Middlesbrough, like all clubs, show a variety of profit measures in their accounts, so they need a bit of explanation.

Operating profit is income less all the running costs of the club except loan interest. It is a ‘dirty’ profit measure in that it includes one-off non-recurring costs that are a bit bobbins when trying to work out long term sustainable profitability.

Despite the benefits of parachute payments Middlesbrough lost nearly £100,000 a week last season using this measure, although it is far lower than when the club previously was in the Championship.

Total operating losses in the Championship in 2016/17 were £260 million, so Middlesbrough’s finances appear to be far healthier than those of their competitors.

If these profits were invested wisely in the playing squad then the club should have been in a strong position to compete this season, but this does not appear to be the case.

A bit driver of Middlesbrough’s financial success here is profits from player sales. The likes of de Roon, Rhodes and Ramirez were sold and this helped to reduce the losses to tolerable levels for Steve Gibson.

Stripping out player sale profits and other non-recurring items (redundancies, legal cases, debt write offs etc.) gives a more valid profit measure called EBIT (Earnings Before Interest and Tax).

For Middlesbrough this was a loss of nearly £400,000 a week in 2017/18, despite the benefits of parachute payments.

Nearly every club in the Championship has significant EBIT losses, which were £392 million in 2017, as many owners gambled on spending big to try to secure promotion to ‘the promised land’ of the Premier League, which in reality is a series of severe spankings by big clubs interspersed with celebrating like a loon when beating the likes of Swansea and Bournemouth.

If non-cash costs such as amortisation and depreciation (depreciation is the same as amortisation except this is how a club expenses other long-term asset such as office equipment and properties over time) then another profit figure called EBITDA (Earnings Before Income Tax, Depreciation and Amortisation) is created. This is liked by professional analysts as it is the nearest thing to a cash profit figure.

Middlesbrough’s EBITDA profit was £7.1 million which shows that the club is generating cash from its day to day activities, although as said before, this is mainly driven by parachute payments. This suggests the club was making money which could then be invested in player transfers.

Once trading costs have been paid, many clubs also have to pay interest on their borrowings, which cost Boro £30,000 a week in 2017/18.

Player Trading

Middlesbrough spent £66 million on new players in the year to 30 June 2018 as the club recruited Assombalonga, Braithwaite, Fletcher, Howson, Randolph, Shotton, Christie and Johnson in multi-million pound deals.

The large spend on players is why the amortisation charge in the profit and loss account is so high. Fans often point out that clubs also sell players and that net spend is a better measure of a club’s investment in talent.

Steve Gibson did bankroll a net spend of over £20 million which showed his faith in the managers, although Boro fans might question the quality, if not the quantity, of the recruitment.

The player recruitment does seem to have been funded on credit though, as amounts owing to other clubs increased to over £56 million, compared to just £1.5 million in 2013.

In the footnotes to the accounts it shows that the big spending on 2017/18 has subsequently been reversed as the club had net income of £27.7 million in summer 2018 from selling Traore and Gibson.

Funding

Clubs can obtain funding in three ways, bank lending, owner loans (which may be interest free) or issuing shares to investors. Historically Steve Gibson has lent ‘Boro over £93 million as well as about £90 million in shares, although this did not increase during 2017/18. Instead it looks as if the club bought most of its signings during the season on extended credit terms, which will result in significant payments being made for them over subsequent years.

Summary

Middlesbrough went for broke in 2017/18 in trying to immediately return to the Premier League. The failure to achieve this objective has resulted in cost cutting in the present season but if the club is not promoted this season there will be a tough challenge ahead as income will halve again likely to lead to a player exodus to balance the books unless Steve Gibson is willing to invest substantial amounts of cash once more.

3 Comments

Pete Mild

God…you are so fucking boring….

The Baron

Sorry you were forced to read it Pete x

grovehillwallah

Excellent stuff, many thanks.