Stoke City 2018: Coat(es) of many colours

Introduction:

There’s not a huge number of famous people from Stoke, Stanley Matthews and Robbie Williams come to mind, but then most people may be struggling.

Recent events have brought one person to the public’s attention, and that’s Denise Coates, the main shareholder in Bet365, who own 100% of Stoke City Football Club Limited’s shares.

She was paid £220 million in 2017/18, a record for a private company, which will come as little cheer to Stoke City fans as their club was relegated from the Premier League.

The club was one of the first to publish its financial results for 2017/18.

Key figures for year to 31 May 2018: Stoke City Football Club Ltd

Income £127.2 million (down 7%).

Wages £94.2 million (up 11%) .

Operating losses £30.2 million (up 35.1 million)

Player signings £58.4 million

Player sales £27.9 million

Coates family investment £123 million (up £47 million).

Income:

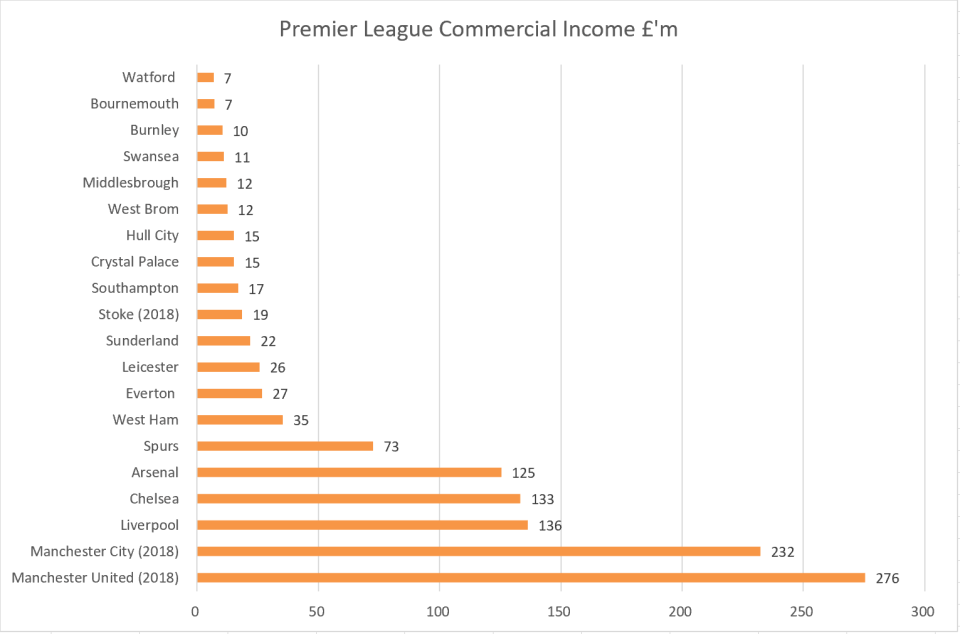

All clubs generate money from three main sources, matchday, broadcasting and commercial. The Premier League is effectively split into the elite, who are regulars in UEFA competitions and have global fanbases who can be ‘monetised, and the remainder of upstarts, wannabes and those just enjoying the ride.

Stoke City are one of the earliest clubs to publish their finances for 2017/18, so the figures in the Premier League tables are from 2016/17 unless the club is labelled 2018.

Stoke’s total income is where most fans would probably expect it to be, in amongst a group of clubs who are likely to be scrapping for relegation during the season, but not adrift from that particular bunch.

Matchday income from ticket sales rose slightly to £7.7 million. This was partly due to some ground redevelopment that allowed the club to increase capacity at the

Matchday income from ticket sales rose slightly to £7.7 million. This was partly due to some ground redevelopment that allowed the club to increase capacity at the Britannia Bet365 stadium to over 30,000. .

Broadcasting income fell 7% to £101 million. This was due to Stoke finishing 19th in the table compared to 13th the previous season. Each position in the table is worth about £1.9 million to a club, so giving them plenty to play for even if relegated is avoided with the few matches remaining at the end of the season. The fact that one place higher up a table is worth more to a club such as Stoke than increasing capacity by 1,800 shows how skewed revenue is in favour of broadcast income.

For 2018/19 expect broadcasting income to fall to about £45 million, and if the club are not promoted, £35m and £14m in the two following seasons. The EFL broadcasting deal for clubs presently pays £2.3 million a season in the Championship, and in addition clubs receive £4.5 million from the Premier League deal in what is called ‘solidarity’ payments.

Other income, mainly commercial and retail, fell by 8% to £18.6 million. Those who snipe at Stoke due to their relationship with owners/sponsors Bet365 will point to this sum being inflated. Whilst Stoke are perhaps a wee bit further up the table in this area than one would expect, it’s by a relatively small amount, compared to the more eye-watering deals signed by clubs with friends of their owners less than 50 miles away.

Costs:

The main costs for a club are in relation to players, in the form of wages and transfer fee amortisation.

The wage bill rose by over £9 million to £94 million. This was due to the club making a lot of signings (who failed to deliver) and a payoff for Mark Hughes when he was sacked in January.

As a consequence, the wage/income ratio rose significantly. Stoke paid out £74 in wages for every £100 of income. The rule of thumb in the Premier League is that clubs are usually aiming for a 60% target.

What’s concerning for Stoke is that if this high cost area is carried over to the Championship it could easily exceed 100%, leaving nothing to pay for the other overheads of running the club.

The other player related expense is that of transfer fee amortisation. This is the cost of signing a player spread over the length of his contract. So, when Stoke signed Kevin Wimmer for £18 million on a five-year contract this works out as an annual amortisation charge of £3.6 million a year (£18m/5years).

Stoke’s amortisation charge rose by 14%, reflecting the investment in the squad during the season. This also shows the inflated prices being demanded by selling clubs when dealing with the Premier League.

The advantage of focussing on amortisation instead of just looking at transfer fees is that it removes some of the volatility from making one big signing in a single year and shows the impact of the club’s long-term player signing strategy. It’s clear that Stoke City’s board backed Mark Hughes as the amortisation charge is now double that of three seasons ago.

Compared to other clubs of a similar size, Stoke’s amortisation cost is competitive without being spectacular. This suggests that relegation was down to spending money poorly, rather than not having a decent budget.

Directors pay

Much has been made of parent company Bet365 paying their board £330 million in 2017/18. That level of generosity doesn’t extend to the football club, but the £711,000 trousered by the highest paid executive at the club means that they are still able to buy a pack of oatcakes or two for a while.

Profits and Losses

Profits/losses are income less costs, and the headline figure was a £30.2 million loss last season, or £580,000 a week. This figure is distorted by a couple of factors though.

Following relegation, the club reviewed the squad and concluded that it was significantly overvalued. They therefore wrote off £29.4 million of player transfer fees. This is a one-off event that is unlikely to be repeated in 2018/19 unless the club does a Sunderland and slides through to League One. Stoke fans are likely to be able to point the fingers at those players who turned out to be turkeys.

One reason for doing this in 2017/18 is that by reducing player values in 2017/18 it will enable the club to be able to satisfy FFP rules in the Championship should they stay there for a few seasons.

Also, in 2017/18 Stoke sold players at a profit (Arnautovic being the main one) of £22 million. This is another erratic and unpredictable figure.

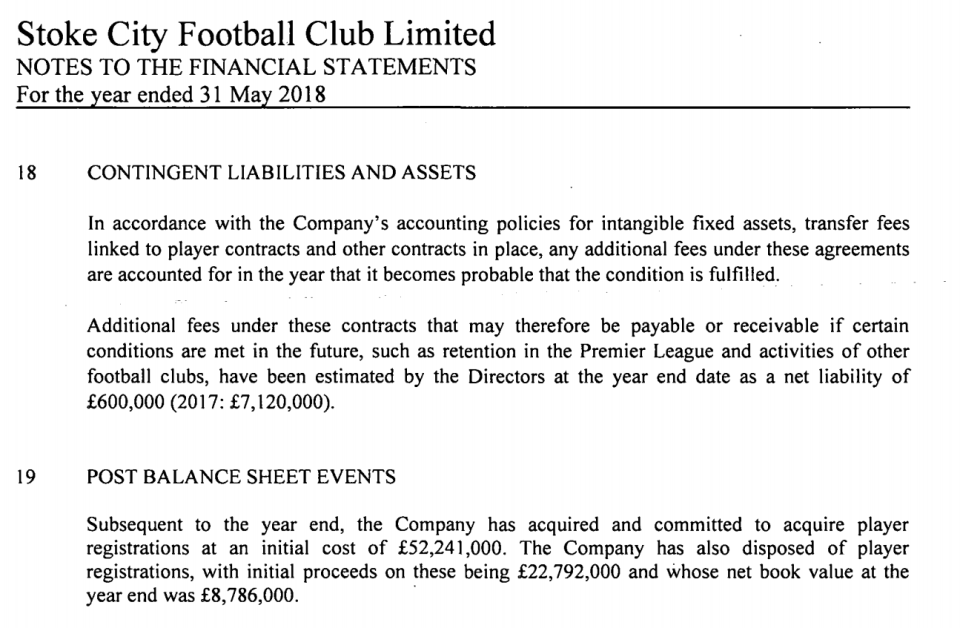

Since the end of the season the club has sold players at a profit of a further £14 million, the main one coming to mind being Shaqiri to Liverpool.

Stripping out the above two distortions gives something called EBIT (earnings before interest and tax) profit, which is a more balanced look at what recurring profits would be.

This is a more alarming than the stated operating losses of £30.2 million. Whilst the club lost a similar amount in 2012/13, since then there have been two increases in EPL broadcasting rights, which boosted Stoke’s TV money from £46 to £100 million. The fact that the club has similar losses in 2018 indicates that a lot of money was wasted last season.

Player trading:

According to the accounts Stoke spent over £58 million in 2017/18 on player signings, a club record. This doesn’t necessarily buy you a lot in the present Premier League market though.

Compared to their peer group, Stoke’s spending was reasonable but unspectacular. The figures reinforce the comments made by Charlie Adam that too many players weren’t prepared to fight hard enough for Premier League survival.

Since the end of the season the board have backed Gary Rowett, with £52 million being spent on new signings, which is a very high figure by Championship standards.

Funding the club

The Coates family total investment increase in 2017/18 as Bet365 invested a further £47 million in the club via loans. These loans realistically stand little chance of being repaid under present circumstances of the club losing so much money. The good news is that with Bet365 making a gross profit of £2.2 billion in the same period there is little chance of the company asking for its money back.

This takes his total investment to £159 million, in the form of shares and interest free loans.

Realistically, the Coates family will have to subsidise the club by a minimum of £10-20 million a year for the foreseeable future, unless promotion back to the Premier League is achieved. The Championship is a bear pit of a division, with practically every club losing hundreds of thousands every month.

Conclusion

Stoke City are a textbook example of everything that is right and wrong with the Premier League. A good season is finishing in the top half, get a few signings wrong and you’re in a scrap to avoid the drop.

The good news for Stoke fans is that there’s no sign of the Coates’ affection for the club in the city where he made their fortune waning. The only threat could come if Bet365 were bought out by another company, but there is no sign of that happening.

The Championship is more exciting than the Premier League, if less glamourous, and provided the club remains competitive in the division there’s probably more enjoyment for fans once they get used to the regularity of Saturday followed by Tuesday football, with victories becoming more expectation than hope.