Arsenal 2017/18: My Friend Stan

Introduction

Stan Kroenke, Arsenal’s invisible owner, saw goodbye to three big players in the club during 2018 as the club went trophy less but perhaps more importantly for the moneymen failed to qualify for the Champions League for the second season in a row.

The power struggle with Ukrainian Alisher Usmanov ended with Stan as the final man standing as he bought out his rival, allowing the American to also take Arsenal from the AIM Stock Exchange to the less scrutinized private company.

Arsene Wenger’s dignified reign as manager came to an end with perhaps sighs of relief from both the Frenchman and his many vocal and at times very angry detractors amongst Gooners.

‘Necessary change and succession’ was the official reason for Chief Executive Ivan Gazidis leaving the Emirates too, which seems perhaps one person too many with experience at the top of the club departing for Milan.

Keeping things quiet has always been the Kroenke way and the way the club’s accounts were added to the website, without any fanfare or accompanying trumpets, was in keeping with his style of communication.

Key Financial Highlights

Turnover £403 million (down 5%)

Wages £240 million (up 20%)

Pre-player sale losses £18 million (previously £53 million profit)

Player sale profits £12 million (up from £7 million)

Player signings £166 million (up 46%)

Income

Reporting income, Arsenal, like all clubs, have three main sources, matchday, broadcasting and commercial.

Overall income fell by 5%, which in an age where clubs are supposed to be making more and more money, is a cause for concern.

Emirates regulars will be familiar with the high prices charged for both season and day tickets to watch Arsenal, but the club appears to have realised that it cannot squeeze more money out of fans for tickets as many prices were frozen for the fifth year in a row.

Nevertheless, matchday income fell slightly, mainly due to the club being unable to generate as high prices, especially for hospitality packages for Europe League fixtures against the likes of Bate Borisov as for Champions League opponents.

Keeping up with Manchester United will be difficult but compared to other Premier League clubs Arsenal’s matchday income is impressive, but there is no room for complacency, with Liverpool and Spurs likely to catch up as capacity increases at their stadia.

Extracting money from fans is never easy, but the high proportion of corporate and hospitality seats at The Emirates means that Arsenal generated £1,660 per fan last season and Arsenal have the highest proportion of income from matchday of any Premier League club as a result.

Due to the way that UEFA allocate TV money, Arsenal’s broadcast income fell by 10% despite the club reaching the semi-final of the Europa League, where clubs receive only a quarter of the prize pot available in the senior competition.

Relative to other clubs in the Europa League Arsenal earned more than any other club in terms of UEFA prize money, mainly due to BT paying a huge sum for the broadcasting rights, a large portion of which then goes to clubs from BT’s ‘domestic’ leagues in England and Scotland.

Only those clubs with Champions League participation (Leicester’s figures are from 2017 when they were in the CL) exceed those of Arsenal, but the gap is one they can ill afford to let grow.

Penalty clauses from commercial partners sponsors for only qualifying for the Europa League may have been the reason why Arsenal’s commercial income fell in 2018 too, albeit by a small amount.

Sponsors want their products to be seen by big audiences, mainly on TV, and this is where the Champions League delivers as it has such a global appeal with armchair fans.

Some £15 million of Arsenal’s commercial income total comes from property income, compared to just £1 million the previous season, otherwise there would have been a far more significant fall from this area.

In comparison to Manchester United, which is in a league of its own when attaching the badge to sponsor products and Manchester City, with its unusually lucrative deals with Middle East partners. Arsenal are generating about half as much from commercial sources, which ultimately has an impact upon the ability to compete in the player market.

Like most clubs, Arsenal generate the greatest proportion of their income from broadcast revenues, but the club does generate more matchday income as a proportion of total than any Premier League team.

Every club in the Premier League is looking to increase income but with TV deals having perhaps reached a ceiling and grounds already full the burden for growth is falling upon commercial departments.

No one at The Emirates will admit it but the danger for Arsenal is that Liverpool are likely to overtake them in terms of revenue when their 2018 figures are released, and Spurs could do the same within two years should they ever finally move to the new stadium.

Costs

The most significant costs for a club are in relation to player wages and transfer fees and here Arsenal saw significant increases in 2018.

Bringing new expensive players to The Emirates meant that the wage bill rose 20% in 2018 to £240 million although included in this figure is a £17 million payoff for Arsene Wenger and his coaching team who departed from the club when The Professor left office at the end of the season.

Urgent investment in the squad necessitated the wage rise and Arsenal were not alone in 2018 in having pay outstrip income, but this is not sustainable in the long run.

The club, compared to the remainder of the ‘Big Six’ are where most would expect to see them, trailing the two Manchester teams and close to Chelsea, the only consolation for Gooners is seeing Spurs having a lower wage bill than Everton although Spurs are yet to report for 2018.

Dividing wages by income gives a ratio that is used by analysts to assess whether a club is spending too much on player remuneration and Arsenal have moved having the second lowest ratio in the Premier League in 2017 to mid-table last season.

Every player signed for a fee also adds to costs in the profit and loss account via transfer fee amortisation, which is calculated by dividing the amount paid over the contract period.

Arsenal’s amortisation cost has more than doubled since 2013 as the club has taken the foot off the brake in terms of player recruitment to try to compete with the other ‘Big Six’ clubs (excluding Spurs).

Despite the investment in the likes of Lacazette and Aubameyang in 2017/18 Arsenal’s amortisation cost is substantially lower than some of their peer group and this may be an indicator why the club failed to qualify for the Champions League as amortisation highlights the medium/long term investment in new players.

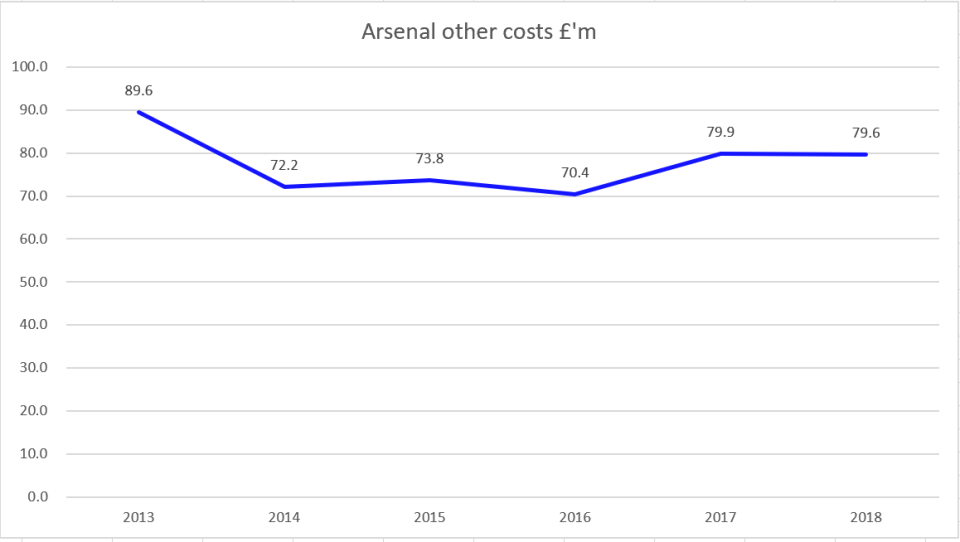

Like all businesses, Arsenal have to also pay for everything from electricity, transport and insurance as overheads and these are now running at about £80 million a year.

Profits

In finance you have to be careful when discussing profits as there are as many types of profit as there are Pringles flavours.

Expenses are usually subtracted from income to arrive at profit, but some expenses are erratic in nature and sometimes excluded when trying to determine a club’s underlying financial health for the season.

Simply deducting all day to day costs from revenue, before taking into account borrowing expenses, meant that Arsenal could claim to have made a record £79 million last season.

A look at the above profit and loss figures shows there has been much volatility in relation to Arsenal’s profits and losses from year to year. This is mainly due to one off transactions which distort the numbers, such as profits on player sales and in the case of Arsenal paying up the contracts of Arsene Wenger and his coaches.

Most analysts ignore finance, tax and one-off costs to create something called EBIT (Earnings before interest and tax) which represents the club’s underlying profit, and for Arsenal in 2018 this converted the profit of £79 million into a loss of £18 million. The main reason for this decline was the combination of lower income and higher player related costs that have been already highlighted.

The EBIT figure shows that running Arsenal is a frighteningly expensive business and therefore the club needs to generate income from an additional source, and that source if player sales.

Arsenal made a record profit of £120 million last season from player sales (Oxlade-Chamberlain, Sanchez, Walcott, Giroud etc) which helped to offset the day to day losses. However, in previous years the club had made minimal profits from player disposals.

If player transfer sales are to be excluded from profit, then there is a case for excluding transfer costs too, which leads to another form of profit, called EBITDA. This is popular with analysts as it is a trading cash profit equivalent.

The good news for Arsenal is that their EBITDA is a positive figure for 2017/18 but £60 million lower than the previous season.

The EBITDA profit at £84 million shows the club is generating over £1.5 million a week in terms of cash, which can then be used to invest in player transfers.

All clubs in the Premier League generate a positive EBITDA, but some are juggernauts and others also rans. Arsenal are certainly generating cash but trail some way behind most of their peer group.

Player Trading

Arsenal spent a record amount on new players in 2017/18 but also had record revenues from sales, which resulted in a net spend of just £28 million.

Spending £166 million on players should have improved the quality of the squad, but the final league position may lead observers to conclude that the acquisitions have failed to improve Arsenal, who ultimately spent less than the other clubs (excluding Spurs) with whom they are competing for a top four place

In a somewhat footnote to the accounts Arsenal did spend a net £61 million in the summer 2018 window on players.

The problem for Arsenal going forwards is that they appear to have some highly paid players on contracts that are unlikely to be matched by other clubs. Getting such players off the books is a delicate negotiating task.

Under a form of financial fair play rule in the EPL called Short Term Cost Control (STCC) clubs can only increase the wage bill by £7million a season plus any extra income they generate from matchday or commercial sources.

Arsenal are snookered here at present as the Emirates is sold out every week and fans won’t tolerate higher prices and so it’s up to the commercial department to make the club attractive, but to do this they need to be able to offer them Champions League football.

A new kit deal with adidas worth £60m a year will help here but when competing with other big clubs it’s a case of running to stand still in terms of wages as other clubs are giving double digit percentage increases.

Media talk is that Emery will be limited to £45m in the market this summer, although if that is a net spend then should still give them a chance to compete.

Funding

Clubs get funding from three sources, bank loans, owner loans (which may or may not be interest bearing) and shares issued to investors.

Arsenal are owned by KSE UK Inc, Stan Kroenke’s private company, but the club also has loans as a legacy of moving from Highbury to The Emirates stadium. The club repaid £8 million of these loans in 2017/18 but paid over £11 million in interest on the outstanding loan balance of £193 million. Whilst this seems a large sum Arsenal had over £230 million in the bank at 30 June 2018, so their net debt position is healthy.

Conclusion

Arsenal are in a tricky position, two years without Champions League participation is costly for a club that has invested so much in player transfers and wages in the last couple of years but to a certain extent they are running to stand still when competing with the other big clubs in terms of player investment (except Spurs).

Stan Kroenke’s motives for running the club are as mysterious as ever. He appears to want Arsenal to be self-financing, which is understandable to a degree, but this may result in the club earning the riches of the Champions League less regularly and finding it harder to attract the best talent in terms of coaches and players, which will restrict growth in terms of commercial deals and further anger Gooners who have been patient to date with Unai Emery but a few more moderate results could result in them returning to the toxic atmosphere that blighted the latter days of Arsene Wenger’s dynasty.