Premier League Club Values 2020

|

|||||

| University of Liverpool Premier League Club Valuations 2020 | University of Liverpool Centre for Sports Business Group | ||||

|

|

Executive summary

- The value of Premier League clubs based on their 2018/19 accounts increased by 1.5% overall to £14.7 billion, with the ‘Big Six’ (Manchester United and City, Liverpool, Arsenal, Chelsea and Spurs) making up £11 billion (75%) of this total (2018: £10.6 billion 73%).

- Spurs overtook both Manchester clubs at the top of the table on the back of reaching the Champions League final, a fourth-place finish in the Premier League and a wage bill barely half that of Manchester United.

- Wolves, acquired for £45 million by owners Fosun in 2016/17 is now worth more than ten times that amount.

- Many clubs have fallen in value due to relatively flat revenues as broadcasting revenues are in the final year of a three-year cycle.

- The median value of a Premier League club fell from £366 million to £291 million.

- The figures do not take into account the impact of COVID-19, which, based on falls in share prices for those clubs who are quoted on stock exchanges, would reduce values presently by 25-35%

Introduction

This is the University of Liverpool’s annual Premier League club valuation report. There are a variety of models used in practice to determine company values, and in an actual takeover deal environment more than one would be used.

At a time of global pandemic football is an irrelevance in terms of its importance to the economy, health, and general wellbeing of nations. We took the decision to publish the results in the context that the findings are just discussion points for fans and not in any way to pretend that it is of any importance compared to the steps being taken to reduce the harm caused by the pandemic.

Some of the values reported do seem intuitively high or low. This is a reflection of shortcomings of any model-based system, but also does perhaps highlight the success or otherwise of some clubs in terms of their business strategies compared to sporting achievements.

Valuation Table

Methodology

The valuation method is broadly based on the Markham Multivariate Model created by Dr Tom Markham, who presently is a senior executive for Sports Interactive, creators of Football Manager.

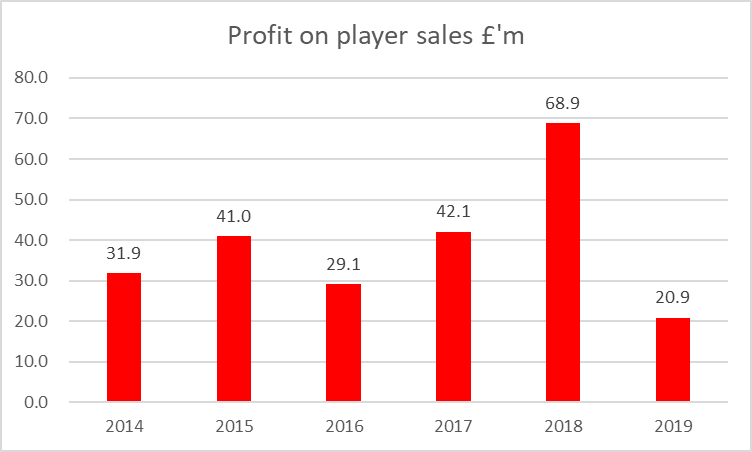

The model takes into consideration the main financial drivers of football club value in the form revenue, profits, non-recurring costs, average profits on player sales over a three-year period (which ties into how the Premier League calculates profits for Financial Fair Play purposes), net assets, wage control and proportion of seats sold.

The figures are derived from the financial statements sent to Companies House.

The model assumes that the club retains its position in the Premier League. For those clubs that have subsequently been relegated to the Championship realistic values are 60-70% lower.

The formula used is

((R+A) x ((R+P-NR+D)/R) x C)/W where

R = Revenue

A = Net Assets (adjusted for ‘soft’ loans from owners)

P = Net profit

NR = Non-recurring items (legal settlements, redundancy, player & asset sale gains/losses etc)

D = Average player sale profit over last three years

C = Average attendance/ Stadium capacity

W = Wages/Revenue

There have been some adjustments to components in the formula from the previous season and these are reflected in the comparative numbers.

As with all models, they should be treated with caution and in conjunction with other models to get a broader indication of club valuation.

Club by Club Analysis

1: Spurs £2,567 million (2018 3rd: £1,837 million)

All clubs have to compromise sporting achievement versus financial sustainability. Spurs’ control on the latter in recent years has meant them having something to put in the trophy cabinet in the new stadium in the form of winning this particular award.

Spurs have a degree of control over wages and player transactions that sets them far apart from their peer group in the so called ‘Big Six’ clubs.

Spurs income increased by 21% to £461 million in 2018/19, on the back of commercial deals at the new stadium and reaching the Champions League final. They achieved this despite their main player expenses, wages, and amortisation (transfer fees divided by contract length) being about half of some of their peer group.

Paying just 39% of their income in the form of wages gives Spurs a significant boost and their ability to keep wages so relatively low is the envy of many other club executives.

Whether this achievement is sustainable in the future is questionable, and a relatively poor season on the pitch in 2019/20 to date may be indicative of their low-cost base catching up with them.

2: Manchester City £2,186 million (2018 1st: £2,364m)

Manchester City’s first place position in the 2017/18 valuation surprised some commentators but was borne out by American investors SilverLake buying a 10% stake in the City Football Group in late 2019 for $500 million.

City’ value decreased slightly in 2019 despite winning three domestic trophies. Income advanced by 7% but the wage bill increased at three times this rate, possibly as a result of bonuses being paid for achieving targets in terms of trophies won on the pitch.

Since Pep Guardiola was appointed as first team manager City’s wage bill has increased by over £100 million and this has meant that profits have been relatively static.

City’s value is underpinned by the investment of Sheik Mansour’s Abu Dhabi United fund, which has allowed the club to have relatively low debt levels.

3: Manchester United £2,080 million (2018 2nd: 1,935m)

Manchester United’s value increased in 2019 due to an increase in profit on the back of slightly better player sales, lower tax charges and better overall cost control.

Whilst intuitively one might expect Manchester United to lead the valuation table they have had significant commitments in the form of interest charges on loans, which reduce profits, and dividends to shareholders, which reduce net assets.

Manchester United’s income advantage has been on the back of commercial deals with a variety of partners, but this advartage has stalled in recent years as the lack of on pitch success has led to commercial income plateau.

Manchester United were in danger of being overtaken in terms of generating the most income in 2019/20, but this is now less likely following Covid-19 which is likely to restrict income growth at both Liverpool and Manchester City, United’s biggest threats here.

4: Liverpool £1,553 million (2018 6th: £1,356 million)

Liverpool’s value increased in 2018/19, and the figures do not reflect the club winning the Champions League, which took place on June 2nd 2019 but their accounts go up to 31st May.

Had it not been for Covid-19 a further sizeable increase in the value would have been anticipated for 2019/20 on the back of the Champions League bonuses, World Club Championship success and almost certainly being Premier League champions too.

Liverpool’s owners FSG have seen a significant return on the £300 million that it cost them to buy the club in 2010.

Wage costs at Liverpool have doubled since 2015 as the club’s strategy appears to be to aim to break even on a day to day operating basis. The wage to income metric has operated in a relatively tight 56-58% band over recent years apart from the season that Jurgen Klopp was recruited.

Liverpool’s profits have been generated from player sales. Whilst this is an erratic and volatile method the supply line of players from Anfield in recent years has been such that they have made over £300 million from this strategy since 2015. These profits have been reinvested in improving the quality of the squad.

5: Arsenal: £1,374 million (2018 5th: £1,471 million)

Arsenal’s value has fallen for the second consecutive year due to once again only qualifying for the Europa League instead of the Champions League.

Revenue fell despite reaching the final of the Europa League, highlighting that this competition is a relatively minor earner and that Thursday evening football, especially in the early stages of the competition, is not a big draw for fans, broadcasters, or sponsors.

Arsenal are in danger of becoming detached from the rest of the ‘Big Six’ in terms of generating revenue and are falling further and further behind their peers in terms of the one area that the club can potentially grow, that of commercial income.

Arsenal made a pre-tax loss for the first time in many years as player sales generated £12 million profit compared to £120 million the previous season.

In 2017/18 Arsenal had to rely on player sales to reverse operating losses of £18 million as Oxlade-Chamberlain, Sanchez, Giroud and Walcott helped generate a profit of £120 million on disposals.

Less money in from player sales meant a lower investment in terms of recruitment too. Another season in the Europa League in 2019/20, combined with a relatively early exit from the competition is likely to see a further fall in Arsenal’s value.

6: Chelsea £1,231 million (4th: £1,615 million)

Chelsea’s value fell significantly in 2018/19 due to the club registering pre tax losses that exceeded over £100 million.

Chelsea’s income was static during the year as lack of Champions League participation led to falls in matchday and broadcast income. This was broadly matched by an increase in commercial revenue.

Chelsea have a disadvantage compared to the other ‘Big Six’ clubs in that the capacity of Stamford Bridge is considerably lower than that of the rest of its peer group.

Wages increased by 11% and transfer fee amortisation 40% resulting in Chelsea having player costs of £102 for every £100 of income, which helps explain the significant operating losses.

Roman Abramovich bankrolled a big spend on players resulting in the club being the biggest spenders on players last season.

Abramovich’s motives are as opaque as ever. His decision to stop progress in relation to moving to a new stadium appeared to be a reaction to a falling out with the UK government over visa issues.

He then lent Chelsea a net £248 million in 2018/19 to underwrite the investment in playing staff which seems inconsistent with his approach in relation to the stadium.

7: Wolverhampton Wanderers £458million (2018: Championship)

Wolves’ appearance this high in the table in their first season in the Premier League is likely to be questioned, but this reflects their success both on and off the pitch.

Wolves invested £111 million in player additions in 2018/19, but this resulted in a 7th place finish and qualification for the Europa League.

Wolves had relatively good wage control, paying just £53 in wages for every £100 of income, the fourth best in the division. Expect this to increase in future years as further signings and new contracts for established players outstrips revenue. This will have a negative impact upon the valuation when wages rise.

Owners Fosun have made a spectacular return on the £45 million it cost them to buy the club in 2016.

8: Newcastle £387 million*

Newcastle disappointingly but unsurprisingly have not published their 2018/19 accounts, so the above valuation is based on 2018 figures adjusted for changes to the model formula. UK Chancellor Rishi Sunak made an announcement in late March 2020 that companies could take an additional three months if they wished in submitting their accounts.

Mike Ashley, a master at the dark arts of Companies Act compliance, was one of only two Premier League teams to take advantage of this change to the rules.

Newcastle are presently subject to an estimated £300 million sale, which takes into account the disruption of COVID and Newcastle’s wage bill presently likely to be considerably higher than the 2018 figure of £93 million. This will reduce profits and increase the wage/income ratio, both of which would cause the MMM value to fall.

Profits in 2018 were £21 million due to good cost control and modest transfer spending, an issue which has frustrated many of Ashley’s critics, who feel more money should be invested in the playing squad.

9: Burnley £350 million (2018 8th: £398 million)

Burnley’s regular appearance in the top half of the valuatoin table always provokes queries, but ultimatly reflects that they are in many ways the club that punches above their weight both on and off the pitch.

Burnley’s income decreased slightly in 2018/19 despite participation in the Europa League. A fall from 7th to 15th in the Premier League meant far lower prize money (this works out at about £2m per place in the final table) which offset the additional revenue from Europe.

Burnley’s success is built around a modest wage and transfer fee budget. They usually recruit domestic players who have proved themselves to be successful in the Championship.

Burnley have not required any cash injections from their owners for a decade and have the ability to deliver profits on an annual basis when they are in the Premier League and modest losses when in the Championship.

10: Leicester £304 million (9th: £378 million)

Leicester’s value decreased significantly in 2018/19 mainly due to costs rising far faster than revenue. Leicester have invested significantly in players since winning the Premier League in 2016, and this has caused both wage and transfer fee amortisation costs to accelerate.

Leicester had wage and amortisation costs of £120 for every £100 of income in 2018/19. Whilst this was offset to a degree by profits on player sales, it is indicative of the challenges for any club that is attempting to break into the ‘Big Six’.

The sale of Harry Maguire and a potential Champions League finish in 2019/20 should generate an increase in Leicester’s value.

11: Watford £279 million (2018: 18th £168 million)

An improved Premier League position, FA Cup final appearance and a reduction in the wage bill have contributed to Watford’s value increasing in 2018/19.

In addition the sale of Richarlison to Everton meant the club made £22 million in player profit sales.

Like many of the ‘Other 14’ clubs Watford are reliant upon Premier League broadcast income for most of their revenues. This was a major concern earlier in 2019/20 after a poor start to the season, but with improved form under Nigel Pearson they now have a fighting chance of staying in the top division.

Watford, like most clubs in the Premier League, are still making losses on a day to day basis, but player sale profits covered those losses in 2018/19.

12: Fulham £276 million (2018 Championship)

Fulham’s value looks high and benefits from the club being promoted to play in the Premier League in 2018/19. What is becoming increasingly common is that clubs make a profit in their first season in the topflight but that is quickly reversed. Fulham however made a £21 million operating loss in 2018/19, partly due to an increase in wages but also due to spending £120 million on new signings.

Fulham’s results suggest that regardless of division, parachute payments or promotion, owning a football club is an expensive business, with losses averaging £500,000 a week over the last seven years.

13: Southampton £269 million (2018: 10th £369 million)

Southampton made an operating loss of £58 million in 2018/19, so their relatively high position in the valuation table may seem at odds with their day to day trading activities.

The club’s main ability is to develop players and sell them at a profit. Since promotion to the Premier League Southampton have generated over a quarter of a billion pounds of profit on player sales.

Whether the club can continue to make such gains in the post-COVID 19 transfer market is uncertain, as the consensus of views is that fees will be significantly depressed as sellers may be prepared to accept fire sale prices and buyers have limited funds to spend.

14: Everton £257 million (11th: £363 million)

Everton were valued at £175 million when Farhad Moshiri acquired the club in 2016. Their relatively modest present valuation is due to a significant investment in players which have been hit and miss in terms of improving results.

A repeat of the 8th place finish the previous season meant no additional prize money for Everton, wages increased partly due to their accounting period being extended to 13 months and the amortisation charge continues to grow rapidly as Richarlison was added to the squad.

The combined impact of this investment in players resulted in an operating loss of more than £100 million. This is sustainable in the short term under Premier League Profitability and Sustainability rules. Everton have had this season to resort to some unusual transactions, such as selling an option on naming rights for their yet to be approved stadium, to stay within the limits.

Everton are limited by the size and age of Goodison Park, where matchday revenues of £14 million make up just 8% of the total. A move to the new stadium at Bramley Moor Dock is essential if the club wishes to start to challenge the ‘Big Six’ financially.

15: West Ham £248 million (12th: £321 million)

West Ham is another club who most fans would expect to be valued higher than the £248 million produced by the model. CEO Karren Brady values the club at £800 million.

West Ham certainly have the potential to be higher in the valuation table, but their financial performance has held them back. Playing at the London Stadium should in theory result in substantial matchday income, but this has risen only modestly since the move from the Boleyn Ground. This is partially due to season ticket prices being relatively cheap compared to some of the other Premier League clubs in London.

West Ham’s owners have a strained relationship with fans, but there has been significant investment in players in recent seasons, but this has not been converted into improved performances on the pitch.

16: Cardiff £223 million (2018: Championship)

Cardiff effectively took an ‘air shot’ in respect of their season in the Premier League. Revenue increased as a result of promotion, but the wage bill was by some distance the lowest in the Premier League.

Research constantly there is a positive correlation between final league positions and wage levels. It is therefore no surprise that the two clubs with the lowest wage bills in the Premier League were relegated and two of the three highest wage expenses were incurred by the winners and runners up.

Cardiff made a profit before tax of less than £3 million, but this was after taking into consideration the full cost of the transfer of Emiliano Sala, the young man tragically killed shortly after signing for the club in January 2019. Cardiff also wrote down other transfer fees by nearly £12 million to further depress profits.

Cardiff’s main achievement was promotion from the Championship the previous season under Neil Warnock despite negative net spends on players in that division for four seasons.

Realistically their value will have fallen by about two-thirds at least following relegation.

17: Crystal Palace £200 million*

Crystal Palace’s valuation is based on their 2018 accounts, as like Newcastle, they have taken advantage of the relaxation of rules in relation to publishing their accounts.

Conspiracy theorists and rivals will no doubt use this to criticise Palace but there is no evidence of any undue financial stress.

Palace’s strategy since promotion to the Premier League is one of paying wages that many would consider relatively high for a small club, as well as a £240 million investment in players.

Whether the club can reduce the wage bill is open to question. Wilfried Zaha is one of the most coveted players in the Premier League and is paid accordingly to keep suitors away.

Palace had a sizeable loss in 2017/18 which kept the club value low and the club’s profits have fallen every year since promotion which has a further negative impact upon the valuation.

18: Brighton £187 million (2018 15th: £234 million)

Brighton avoided relegation in 2018/19 but it came at a financial cost. The £9 million operating profits of the club’s first season in the Premier League became a £25 million loss as player costs increased by 39% but revenue only 3%, despite an FA Cup semi-final appearance.

Brighton owner Tony Bloom has continued to invest in the club despite it reaching the Premier League.

Brighton have invested significantly in players in recent years in both the Championship and the Premier League. Player sales however have been relatively modest, and this has meant that operating losses have effectively been borne by the club owner.

19: Huddersfield £178 million (2018: 13th: £242 million)

Huddersfield were sold at the end of 2018/19 for an estimated £60 million. This coincided with the club being relegated from the Premier League, and ties in with the view that clubs in the Championship suffer a 60-70% fall in value in the second tier of English football.

Huddersfield’s income declined and wages were static. Income due to finishing lower in the Premier League and wages because many player contracts were bonus driven in relation to avoiding relegation.

However, transfer fee amortisation increased as Huddersfield spent a further £46 million on signings in 2018/19.

20: Bournemouth £99 million (2018 20th: £158 million)

Bournemouth’s value decreased due to the pincer movement of lower revenues and higher costs, especially those relating to players.

With a stadium capacity of only 11,000 the club is heavily reliant upon broadcasting income for most of its total, and the club, which was in the third tier of English football as recently as 2012/13, has been transformed by membership of the Premier League.

Bournemouth are not alone in their dependency on broadcast income with eleven Premier League clubs generating at least three-quarters of revenue from this source.

Bournemouth’s finances are further evidence of the myth that the Premier League is paved with gold for club owners. In 2012/13 the club was in League One, since then its income has increased by £126 million, but player costs have increased by £134 million.

Conclusions

The Big Six clubs continue to be very valuable and their dominance of revenue streams is likely to ensure that the gap between themselves and the remaining clubs in the Premier League is maintained.

Cost control is proving to be very difficult for all clubs in the division, especially in terms of wages and this may restrict future growth in the value of clubs especially with broadcast revenue growth slowing. Wages as a proportion of revenue grew in 2018/19 as the Premier League entered the final year of the three season deal with Sky and BT. Broadcast revenues were set to rise slightly in 2019/20 but it is unlikely to match wage growth.

Underlying profitability (pre tax and interest, excluding one off transactions and player sales) shows that Premier League clubs had a collective loss of £384 million, assuming that Newcastle and Crystal Palace’s results are the same as the previous season.

The pandemic, which of course relegates football to the sideshow in life that we have always secretly known it to be, will have had a significant impact upon the figures for the present and future seasons. Revenue streams will be reduced as matches being played in front of fans may not return until 2021. Transfer fees will decrease significantly as so few clubs will have cash to spend. In the short-term wages may fall slightly, where they will go as long-term contracts expire will be determined by long term revenue trends.