Newcastle: Opportunity Knocked

Introduction

Regular reference is made about the ‘Big Six’ clubs in the Premier League and the disproportionate amount of wealth, transfer spend and media exposure that they generate.

These clubs (Manchester United and City, Spurs, Arsenal, Liverpool and Chelsea) seem to have created a glass ceiling which is almost impenetrable to break (with the notable exception of Leicester in 2015/16 as they jostle for Champions League (CL) positions, having taken 60 out of 62 places in the CL since 2004/5.

One of my chums on Twitter, called @TheGingerPirlo_ , asked about Newcastle United, a club who had been successful in the early 2000’s, and an assessment of Mike Ashley’s reign of terror, misery ownership on Tyneside compared to what has happened at Spurs during the same period. Should Newcastle have been one of today’s ‘Big Six’ instead of Spurs?

The guv’nor of football finance, Kieron O’Connor at the Swiss Ramble, has already given his always brilliant assessment of the two clubs’ monetary performance and position on Twitter, but here’s further analysis for those who want any additional information.

Ashley acquired control of NUFC on 15 June 2007, after initially acquiring 41% of the club the previous month.

On that momentous day Rihanna (and Jay Zed) were number one in the pop charts with Umbrella, Tony Blair was prime minister and still reasonably popular, Sid the Sexist in Viz was a virgin and Michael Owen was Newcastle’s record transfer signing…some things haven’t changed since then.

Spurs’ record signing at the time was Dimitar Berbatov, a signing that has since been exceeded 18 times.

Finances pre Ashley

In the eleven years prior to Ashley taking over Newcastle, the club’s league position compared to that of Spurs was as follows.

Newcastle’s average league position was 8th, compared to that of Spurs’ 10th, and the Toon had had four top four finishes during that time period, whereas Spurs highest finish was 5th. Newcastle finished above Spurs on seven occasions during the period in question.

Since Ashley took over, the situation has reversed.

Newcastle have finished below Spurs in each of the 11 seasons since Ashley took over, with an average position of 14th, compared to 5th for Spurs.

When Ashley acquired Newcastle, the key financial figures for both clubs for the previous year was as follows:

Income

Spurs overall had revenue of £103 million compared to £87 million for Newcastle. The main reason for this was that Spurs had a higher league finish coupled with decent cup runs (UEFA Cup QF, League Cup SF, FA Cup QF) as well as the attraction to commercial partners of being based in London. Newcastle’s additional capacity at St James’ Park meant that they had an advantage in terms of matchday income. The retirement of Alan Shearer and a major injury to Michael Owen meant that Newcastle had a relatively poor season on the pitch.

Costs

The main operating costs for a club relate to players in terms of wages and player amortisation (transfer fees spread over the contract term, so Berbatov signing for Spurs for £11 million on a four-year contract works out as an amortisation fee of £2.75 million a year).

This may cause Newcastle fans to drop their bacon sandwiches (this is of course less likely to be an issue for Spurs fans) but in 2006/7 their club’s wage bill was 43% higher than Spurs at £62.5 million. There was little difference in the amortisation charge.

Spurs therefore only spent £42 in wages for every £100 of income, whereas for Newcastle it was £72.

Spurs had a successful time in the transfer market and made a profit on player sales of £18.7 million, mainly due to the sale of Michael Carrick to Manchester United, whereas Newcastle lost £1.9 million.

Newcastle also had a number of additional expenses that year. The sacking of Glenn Roeder cost £1.1 million in compensation, the takeover by Ashley led to a number of directors leaving the club, which added a further £2.2 million to expenses, and £2.9 million in relation to some aborted takeover bids and financing a stadium expansion took one off costs to £6.1 million. This was however offset by a £6.7 million compensation claim against FIFA and the FA relating to Michael Owen suffering an ACL injury in the previous year’s World Cup.

What is clear is that Spurs, under the astute leadership of Daniel Levy, controlled their costs well and this meant that the club was profitable, unlike Newcastle, where the Hall/Shepherd era was coming to its final throes, which made losses under practically every performance measure.

Profits/losses

Of the above profit measures, we believe that EBIT and EBITDA are the most relevant ones, as they exclude one off transactions such as profits on player sales and compensation for sacked managers. Spurs were making broadly £30 million more than Newcastle in 2006/7 under both these measures, so Ashley was inheriting a club that whilst it had been more successful on the pitch in the previous decade compared to Spurs, had some warning signs in its finances.

The Ashley Years: 2008-17

Income

Newcastle continued to have an advantage in terms of matchday income for the first two seasons under Ashley, but relegation in 2008/9 reversed this picture and Spurs have reinforced this ever since. This is mainly due to participation in UEFA competitions, combined with increasing prices for matchday packages as White Hart Lane is a popular destination for football tourists.

In 2006/7 Spurs generated £863 per matchday fan per season, compared to £608 at Newcastle. By 2017 Spurs had increased theirs to £1,433 per fan, helped by four matches at Wembley in the Champions League & Europa Cup. Newcastle, playing in the Championship made only £458 per fan, as the likes of Burton and QPR were clearly less attractive than Monaco and Bayer Leverkusen.

With Spurs new stadium coming on stream in 2018/19 at eye watering prices, and another year in the Champions League, expect the gap here to grow even further.

Broadcast income was neck and neck between the two clubs in Ashley’s first year of ownership, but again relegation in 2009 changed the dynamic between the two clubs and that has been magnified ever since by Spurs.

With BT Sport paying huge sums for Champions League rights, along with approximately a £2m increase per domestic place in the Premier League, Spurs are likely to generate £100 million a year more from broadcasting than Newcastle as long as they continue to qualify for Europe.

In terms of commercial income, Spurs have a geographical advantage due to being London based, and therefore more appealing than Newcastle to global brands and partners. Newcastle have suffered too due to the Sports Direct and Wonga factors. Other sponsors are reluctant to be seen alongside the logo of the carrier bag of choice of those who like to wear velour onesies and use payday loans to fund their daily purchases of wifebeater from Bargain Booze.

Spurs generated total income of £616 million in the decade before Ashley arrived, compared to £709 million for Newcastle.

In the decade since Ashley took control, the reversal is depressing for Toon fans. Spurs income has risen 175% to £1,696 million whereas Newcastle’s has increased only 39% to £986 million, representing a huge lost opportunity.

I

Costs

Spurs have overperformed in terms of on the field performances compared to the wages they pay. The other ‘Big Six’ clubs pay substantially more, so it is credit to the negotiation skills of Daniel Levy in agreeing wages with staff that are lower than that of Spurs peer group (except for the pay of the highest paid chief executive in the Premier League…Daniel Levy, who earned £6m in 2017/18)

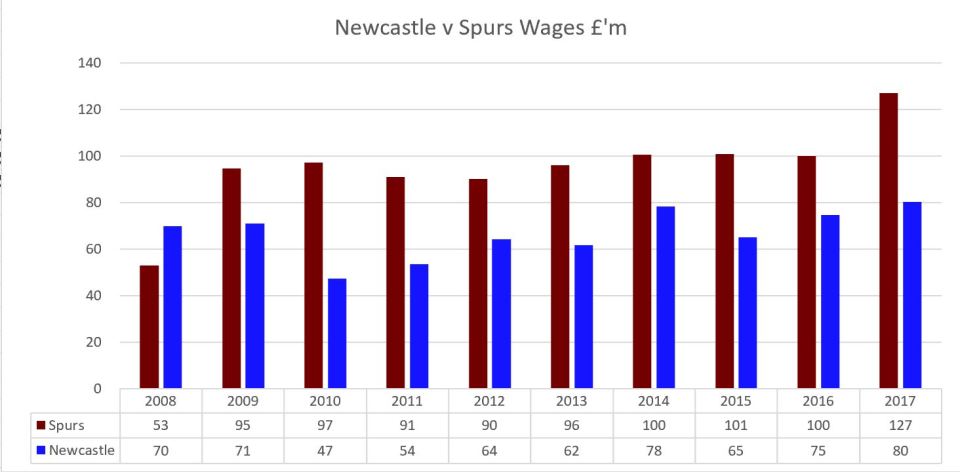

In Mike Ashley’s first season as owner Newcastle’s wage bill was 32% higher than that of Spurs. His reluctance to invest in players (and pay them accordingly) as new TV deals were agreed resulted in a reversal of this situation, even when compared to the relatively parsimonious (compared to the rest of the Big Six) wage levels being paid at White Hart Lane.

Overall Ashley has paid out a beastly £666 million in wages over the decade compared to £950 million at Spurs. You pay peanuts, you get Xisco, Titus Bramble and Stephane Guivarc’h…and relegated twice.

At the same time Spurs have keep their wages relatively low compared to income, but by boosting income levels it allowed them to increase the wage total.

The same reversal of spending had arisen in relation to player amortisation.

Ashley’s reluctance to invest in the transfer market is very evident. There was a £3m difference between the two clubs in the year before he took over, but since then Spurs have had a total amortisation charge of £364 million, nearly twice that of Newcastle’s £192 million.

If clubs fail to invest in player recruitment, then this has a knock on effect when it comes to selling players at a profit.

Spurs have benefitted from signing the likes of Modric and Bale and then selling them to Real Madrid, but they were prepared to invest in the first place. Newcastle, by rummaging around the bargain bins on a more regular basis, were more likely to struggle to make a return on those players as many failed to make the grade. Overall Spurs have made a profit of £324 million whereas Newcastle have only made £180 million.

One area where Newcastle have benefitted from Ashley’s ownership is that he paid off the club’s loans and lent the club money interest free. This has resulted in Newcastle only paying £8 million in interest over the decade compared to £55 million at Spurs.

The downside of this is that because it is his own money he had been lending, Ashley has been overly cautious in financially supporting the club once his initial enthusiasm waned.

Spurs have borrowed money most years, and this has been used to fund infrastructure projects as well as the transfer market. Under Ashley, Newcastle have borrowed a net £4 million in the last 7 years, and this was mainly in 2016/17 as the owner needed the club to return to the Premier League to have a chance of selling it for his desired price of £400 million.

Transfer Market

Both clubs have a reputation for caution in the transfer market and this is reflected in the figures. Newcastle have outspent Spurs in terms of recruitment three times in the last decade (and this is likely to be repeated in 2018/19 too), but overall Spurs have spent £564 million in the period compared to just £331 million by Newcastle.

Net spend is a topic that gets many Newcastle fans into an anti-Ashley frenzy, and here they have some justification.

In the first eight years of Mike Ashley’s ownership, there was a net overall spend of just £5.6 million, whereas Spurs net spend was £81 million, despite the sales of Bale and Modric.

Summary

First of all credit should be given to Spurs for having a plan, they wanted to move to the next level in the Premier League, and through excellent recruitment and good cost control they’ve managed to become a club that is expected to challenge for UEFA cup competitions each year.

Ashley’s ownership of Newcastle is baffling. If he wanted to make a fortune by selling the club at a healthy profit, then refusing to invest in the assets that generate the best return, in the form of players, has come back to bite him in the bum.

When he acquired the club in 2007 it was in a prime position to challenge for the top four regularly. Whether he took the eye off the ball (Daniel Levy’s investment in Spurs is 24/7) due to the other elements of his business empire, or a belief that his successful methods in running his retail empire could be transferred to a football club, is unclear.

With the Big Six clubs being worth at least £1 billion each, and Ashley hawking Newcastle around for about £350 million, his period of ownership has cost him hundreds of millions due to his focus on spending as little as possible to keep the club in the Premier League instead of one of ambition on the pitch.

The last decade has been a lost one for Newcastle, and the problem is it is a situation that cannot be seen to be reversed under the present management, and even a new owner, given the wage constraints of the Premier League’s STCC rules which are aimed at reinforcing the status quo in terms of the Big Six, will face an almost impossible task at breaking through the glass ceiling.

The Ashley Years Table