Fulham: Tiger Feet

Fulham 2017

Trying to work out the exact state of Fulham’s finances isn’t easy. You would think that the logical place would be Fulham Football Club Limited, but this company doesn’t appear to own Craven Cottage. A bit of ferreting around leads to Fulham Football Leisure Limited, which owns not just the Football Club Limited but also Fulham Stadium Limited (for Craven Cottage) and FL Property Management Limited (for the training ground) and an Irish based Motspur Park Ltd (also for the training ground).

We were just about to analyse these figures when up popped the groovy sounding Cougar Holdco London Ltd, which was created when Fulham Owner Shahid Khan bought the club from Mohamed ‘Fuggin’ Al-Fayed in 2013. It’s therefore this final company that we will concentrate on in the analysis.

Summary of key figures

Fulham were relegated from the Premier League in 2014, so the year ended 30 June 2017 was their third, and penultimate, in which they receive parachute payments.

Income £34.9 million (down 3%)

Broadcasting income £21 million (down 15%)

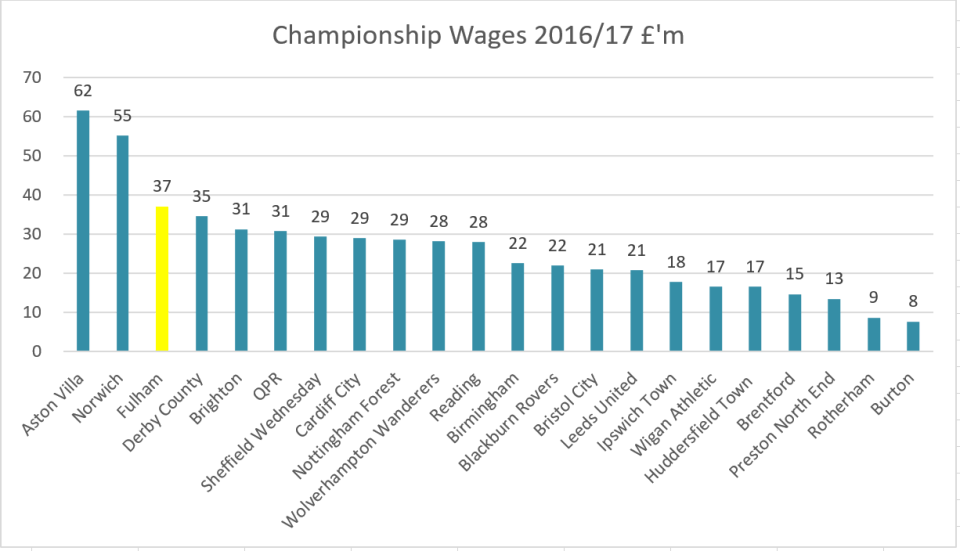

Wages £37.1 million (up 3%)

Loss before player sales £30.1 million (up 54%)

Player purchases £24.9 million

Player sales £22.5 million

Borrowings £152.8 million

Income

In the Championship the amount of total income is effectively split between those clubs that do and do not receive parachute payments.

Only Newcastle (surely Mike Ashley has nothing to hide?) and recently sold Barnsley have yet to announce their results for 2016/17. Most clubs are showing higher income than in the previous season. The average income of the 22 clubs that have reported to date is £28.6 million. This compares to an average of £22.9 million the previous season.

The main reason for the increase is due to a combination of higher parachute payments, a new TV deal in the Premier League, which drips down to the Championship in what are called ‘Solidarity Payments. Championship clubs earn about £4.3 million a year from solidarity payments, plus their earnings from the Football League TV deal which are worth a minimum of a further £2 million.

The English Football League (EFL) negotiated a flat percentage of all future TV deals with the Premier League (PL) a couple of years ago. This at the time seemed to be a great deal, but subsequently the PL sold its domestic rights for 10% less in 2019-22 than the current three-year arrangement generates.

Like all clubs Fulham earn their income from three sources, matchday, broadcasting and commercial/sponsorship.

The table shows how much Fulham benefitted from being in the Premier League until 2014, when it peaked at £91 million.

Matchday income in 2016/17 was up 17%, as the average attendance increased by an average of 1,500 to 19,200 as the club reached the Championship playoffs.

Fulham are in the top half of the division in terms of matchday income, due to a combination of reasonable crowds and being able to charge London prices. Having said that, matchday income accounts for less than £1 every 5 of Fulham’s overall income.

Broadcast income was down 15% to £21 million. This was due to the nature in which parachute payments are paid to clubs, which are half in years three and four of those in year two. Fulham will receive the same amount of broadcast income this (2017/18) season as last year, but their parachute period then finishes.

From 2018/19 onwards, broadcast income will be about £6.3 million a season, although the club gets an additional £100,000 for every home, and £10,000 for every away game that is broadcast live on Sky.

The impact of parachute payments for the top six clubs in the chart is very evident. Recently relegated Norwich earned £7.50 from broadcasting for every £1 earned by non-parachute payment clubs.

Commercial income increased by a quarter, although that figure is distorted slightly by Fulham receiving nearly £1.3 million in mysteriously named ‘compensation’

Costs

The main costs at a football club are player related, wages and transfer fee amortisation.

Fulham’s wages fell by about 45% after being relegated from the Premier League and have stayed steady in the Championship since then. It’s likely that they will be broadly static for 2017/18 too but will then have to be reduced as parachute payments will disappear from next season.

Fulham’s wages are the third lowest in the division, behind those of the two clubs relegated from the Premier League in 2016/17. We would expect Newcastle’s wage bill to be close to that of Villa, except with a few more win bonuses.

Fulham paid out £106 in wages for every £100 in income. This means there is nothing left over to pay the overheads of running the club, which effectively are being paid for by the club owners. This ratio has increased since relegation as income has fallen due to the decline in parachute payments.

Fulham are not however alone in the Championship in paying out more money in wages than they generate in income as over half the clubs in the division have the same predicament.

Amortisation is how clubs deal with transfer fees in the profit and loss account. When a player signs for a club the transfer fee is spread over the life of the contract. Therefore, when Fulham signed Tom Cairney from Blackburn for £4 million on a four year contract the amortisation charge was £1 million a year for four years (£4m/4). The amortisation fee in the profit and loss account therefore includes all players who have been signed for a fee (assuming they are still in their initial contract).

Fulham’s total amortisation charge more than doubled to £13.7 million, reflecting the club’s ambition in signing players in 2016/17 who they hoped would achieve promotion.

If the amortisation costs are added to wages, then total player costs for Fulham in 2016/17 were £145 for every £100 of income. This again suggests the club is spending whatever it takes in terms of player investment to get back into the Premier League.

Profits and losses

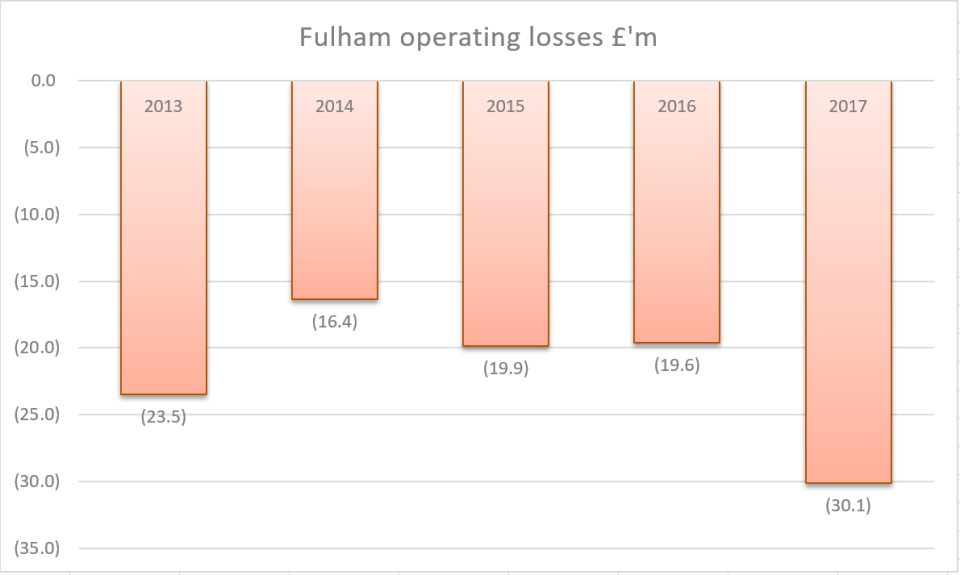

Profits (or more commonly for non-Premier League football clubs losses) are income less costs. The bad news for Fulham is that the club lost a lot of money last season from day to day trading.

The good news is that they managed to sell legendary pie eater Ross “Where’s the keys to my front drive” McCormack to Villa for about £12 million and Konstantinos Mitroglou to Benfica for about £6 million, plus the likes of Smith, Pringle and Stekelenburg, bringing in a profit of over £17 million on these deals, which will help the club in terms of FFP compliance.

Operating losses are income less the running costs of the club (wages, maintenance, insurance, amortisation etc. and they are before deducting interest costs and player sale profits. In 2016/17 this worked out as £30.1 million, or £579,000 a week. These losses are before taking into consideration the one-off cost of £7.1 million the club incurred when writing off £7.1 million of stadium development costs and a £1.5 million write down in player values, who were signed for fees but subsequently turned out to be a bit Andy Carroll.

Even when in the Premier League, Fulham have struggled to make a profit without selling players.

Their total losses for the last five seasons are nearly £110 million, and this excludes one off costs during that period too.

Fortunately for Fulham the club have managed to sell players on a regular basis at a profit of £51 million during this period, but it still leaves a substantial loss.

Under FFP rules, Championship clubs can make a maximum FFP loss of £39 million over three years in the Championship. Fulham have a pre-tax loss of £62.1 million over the three-year period, even after considering gains on player sales of £29 million.

Fortunately, some costs, such as infrastructure, academy and community schemes, are excluded from the FFP calculations. Fulham have a category one academy, which costs about £5 million a year to run, so this, combined with other allowable costs, should allow the club to sneak in under the FFP limit for the three years ending June 2017. Once parachute payments end the club will have to do some serious cost cutting, or sell the likes of Cairney and Sessegnon, to avoid a breach of the rules.

Player trading

The accountants treat player trading in a weird way in the financials. We’ve already shown that when a player is signed, his transfer fee is spread over the life of the contract. When the player is sold, the profit is shown immediately, and it based on the player’s accounting value, not the original transfer fee.

This creates erratic and volatile figures in the profit and loss account.

If we instead focus on the actual purchase and sales, the following arises

Over the last five years Fulham have bought players for £101 million and generated sales of £63 million.

The footnotes to the accounts show that the club also spent a net £3.3 million in the 2017/18 transfer window.

Owner Investment

When the Shahid Khan took over Fulham, the club had debts of £21 million. Since then he has paid £44 million for shares and lent the club a further £199 million up to 30 June 2017. Some of these loans have been converted into shares during that period.

Summary

Shahid Khan has invested significantly in Fulham since acquiring the club, but it’s return to the Premier League is uncertain. Whilst many independent observers would be delighted if the club went up this season, just to see the tantrum thrown by Neil Warnock at Cardiff if it happened, failure to do so in 2017/18 would cause a major operational reorganisation to ensure compliance with FFP, and a breakup of the team that has been playing excellently recently.

Data Set